China Deploys New 'Carrier Killer' Missile

A new report by the Office of Naval Intelligence highlights the growing capabilities of the Chinese Navy.

By Franz-Stefan Gady

A new report by the Office of Naval Intelligence highlights the growing capabilities of the Chinese Navy.

By Franz-Stefan Gady

This week, the Pentagon’s Office of Naval Intelligence (ONI) released an unclassified assessment of the Chinese navy’s new capabilities and missions in the years ahead.

Notably different from 2009 is Beijing’s current shipbuilding program, which is now focusing more on the construction of multi-mission vessels rather than anti-surface warfare combatants.

The most striking revelation of the 2015 ONI report is that the PLAN has apparently already equipped a class of guided missile destroyers with China’s most advanced supersonic anti-ship missile.

“[T]he newest class, the Luyang III destroyer is fitted with the new vertically-launched YJ-18 ASCM,” the report says.

Writing last week (see: 175 Comments), I highlighted that this new weapon constitutes a major threat to U.S. and allied surface vessels deployed in Asian waters.

As of now, only one Type 052D Luyang III-class destroyer is currently in service with the vertically launched YJ-18.

However, the PLAN plans to commission ten more such vessels by 2017 and also plans to deploy the missile on Type-093G and Type-095 submarines.

“In 2013 and 2014, China launched more naval ships than any other country and is expected to continue this trend through 2015-16,” according to the study.

In 2013, the PLAN either laid down, launched, or commissioned more than 60 ships, although the emphasis overall is on quality rather than size.

Looking at just numbers, Beijing already fields a formidable naval force today:

As of this publishing, the PLA(N) consists of approximately 26 destroyers (21 of which are considered modern), 52 frigates (35 modern), 20 new corvettes, 85 modern missile armed patrol craft, 56 amphibious ships, 42 mine warfare ships (30 modern), more than 50 major auxiliary ships, and more than 400 minor auxiliary ships and service/support craft.

The PLAN’s submarine fleet currently deploys 66 boats — five nuclear-attack submarines, four nuclear ballistic-missile submarines, and 57 diesel attack submarines, although the report does not indicate how many of the vessels are, in fact, operational.

Additionally, “by 2020 the submarine force will likely grow to more than 70 submarines,” ONI assesses.

Furthermore the paper notes that “[m]ajor qualitative improvements are occurring within naval aviation and the submarine force, which are increasingly capable of striking targets hundreds of miles from the Chinese mainland.”

The report also points out that China’s Coast Guard — its maritime law enforcement force — has undergone major modernization and is also increasing in size.

Civilian maritime forces have “added approximately 100 new large patrol ships (WPS), patrol combatants/craft (WPG/WPC), and auxiliary/support ships, not including small harbor and riverine patrol boats. The current phase of the construction program, which began in 2012, will add over 30 large patrol ships and over 20 patrol combatants to the force by 2015.”

Other highlights of the report include the mentioning of hitherto little known Wonang-class inshore minesweepers and the confirmation that three Dalao-class submarine rescue ships are in service, as well as four Dongdiao-class intelligence collection ships.

Moreover, the Chinese Navy is rapidly developing ship-based drones.

“The PLA(N) will probably emerge as one of China’s most prolific UAV users, employing UAVs to supplement manned ISR aircraft as well as to aid targeting for land-, ship-, and other air-launched weapons systems,” the report says.

“UAVs will probably become one of the PLA(N)’s most valuable ISR assets.”

As expected, the ONI report points out that the PLAN is still suffering from lack of interoperability, making integrated jointed operations still a difficult proposition for the force:

Despite its considerable rhetorical emphasis on achieving this goal, the PLA’s record of achievement appears mixed during the past decade (…)

PLA leaders and planners are committed to developing systems for conduct of joint operations, but they recognize the complexity of that task and are conscious of the fact that the PLA lacks real world experience.

Last, ONI believes that the commissioning of the Kuznetsov-class Liaoning aircraft carrier — despite “limited combat capability” — is a “milestone” signaling that the Chinese leadership has embraced the idea that fielding a large fleet is essential to achieving great power status.

HOW U.S. NAVY INTEL SEES CHINA’S MARITIME FORCES

By Andrew Erickson

In its first unclassified report on the subject in six years, the Office of Naval Intelligence depicts a powerful trajectory for China’s maritime forces.

By Andrew Erickson

In its first unclassified report on the subject in six years, the Office of Naval Intelligence depicts a powerful trajectory for China’s maritime forces.

Titled “The PLA Navy: New Capabilities and Missions for the 21st Century,” the document and accompanying videos also cover the China Coast Guard—precisely the right approach, since the world’s largest blue water civil maritime fleet serves as “China’s Second Navy” and is on the front lines of island and maritime “rights protection” in the East and South China Seas.

This focus on both the PLA Navy (PLAN) and the China Coast Guard is also especially appropriate given their role as the principal institutions charged with furthering regional sovereignty claims.

The PLAN is also responsible for safeguarding Chinese interests much farther afield, and is gradually developing power projection capabilities to do so.

Looking towards 2020, the Office of Naval Intelligence sees China’s maritime forces on a trajectory of major improvement through hardware acquisition and accrual of operational proficiency.

Chinese shipbuilding capabilities and resources allow both forces to replace old ships with new, far more capable ones.

Last year alone, China’s navy laid, launched, or commissioned more than 60 vessels; the report expects a similar figure for 2015.

More naval ships emerged from Chinese shipyards than from those of any other country in 2013 and 2014.

The Office of Naval Intelligence expects China to lead in naval ship launching in 2015 and 2016 as well.

Chinese naval development remains more a quality improvement swap than a Soviet-style numerical buildup.

PLAN ships include 26 destroyers, 52 frigates, 20 corvettes, 85 missile patrol craft, 56 amphibious vessels, 42 mine warfare ships, more than 50 major auxiliaries, and more than 400 minor auxiliaries.

Beyond the numbers, though, what is most noteworthy is

- (1) the increasing number of vessels with multi-mission capabilities and their ability to operate both near to and far from China, and

- (2) growing numbers of specialized ships.

Type 071 Yuzhao Class Amphibious Transport Dock (LPD) is equipped with one 76 mm gun and four 30 mm Russian-built AK-630 close-in weapon system (CIWS).

Type 071 Yuzhao Class Amphibious Transport Dock (LPD) is equipped with one 76 mm gun and four 30 mm Russian-built AK-630 close-in weapon system (CIWS).

Examples of geographic versatility include four-and-counting Yuzhao-class landing platform docks. They can support South China Sea island seizures and potentially even overseas expeditionary warfare.

In other revelations, the Office of Naval Intelligence explains that China can deploy heretofore publicly-unknown remote-controllable Wonang-class inshore minesweepers.

China has four Dongdiao-class intelligence collection ships, which support growing surveillance operations in the Western Pacific.

Three cutting-edge Dalao-class submarine rescue ships augment Chinese undersea warfare ability, which is relatively strong in the proximate waters that China cares most about.

Likewise relevant to the East and South China Seas: twenty Jiangdao-class patrol corvettes in China’s fleet, with 10-40 additional hulls anticipated.

The PLAN is also introducing UAVs.

The Camcopter S-100 UAV has already been deployed, with a variety of indigenous systems likely to follow soon.

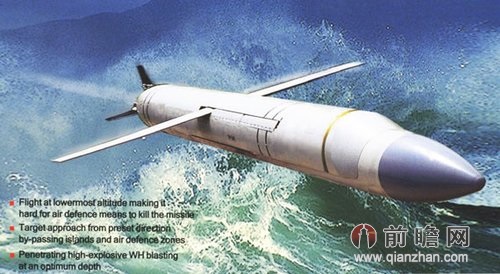

In the most groundbreaking single piece of information in the report, a U.S. government source has confirmed for the first time that Chinese ships and submarines have deployed the potent new-generation supersonic YJ-18 anti-ship cruise missile.

YJ-18 anti-ship cruise missile

Previously designated the CH-SS-NX-13 by the Department of Defense, it is apparently a copy of the 3M54E Klub (SS-N-27B export variant), with which Russian Kilo-class 636M subs are equipped. Like the Klub, the sea-skimming YJ-18’s high speed and terminal trajectory make it extremely difficult for ships’ air defense to thwart.

While most PLAN growth is primarily qualitative, the China Coast Guard is undergoing both a qualitative and a quantitative buildup.

Over last decade, it received 100 new large patrol ships, patrol combatants and other craft, and auxiliary ships.

Between the beginning of 2012 and the end of 2015, the report projects, the China Coast Guard will have added more than 30 large patrol ships and more than 20 patrol combatants—an overall hull increase of 25%.

No other Coast Guard in the world is remotely close to that rate of growth.

And China already boasts the world’s largest blue water coast guard fleet.

Compared to its maritime neighbors, the numbers are grossly in Beijing’s favor.

China has more Coast Guard ships than Japan, Vietnam, Indonesia, Malaysia and Philippines combined (China’s smaller neighbors are in another civil maritime category entirely: the minor leagues).

While the Japan Coast Guard is extremely competent, it is already behind quantitatively and the gap will likely only grow.

To ensure that these hardware advantages can be translated into overall capabilities gains, however, the PLAN must continue to improve its training, coordination, and jointness.

To truly master long-range precision strike weapons that it emphasizes in the hopes of deterring—and if necessary defeating—U.S. intervention, China must maintain awareness over a tremendous swath of ocean and airspace.

The China Coast Guard faces less lofty operational objectives, but must continue to consolidate and organize itself effectively, no small task given its swelling ranks and the large number of new ships it needs to integrate.

If Beijing can continue on its present maritime trajectory, its neighbors and the United States are in for substantial challenges.

Chinese sources frequently invoke “three million square kilometers of blue territory,” which equate to approximately 90% of the major waters within the First Island Chain (Bohai Gulf, Yellow Sea, East China Sea, and South China Sea).

Already, China is engaged in massive island construction in the South China Sea, likely to give its maritime forces a better set of outposts from which to uphold and extend its claims there.

There are numerous flashpoints in both the East and South China Seas, with frequent and deliberate vessel collisions during the Sino-Vietnamese Haiyang Shiyou 981 standoff in 2014 particularly worrying.

The Office of Naval Intelligence judges that the clash “could easily have escalated into a military conflict.”

China is also becoming more active in distant seas.

The report concludes that carriers, ballistic missile submarines and possibly large-deck amphibious ships will transform PLAN operations and further increase its international visibility: “in the next decade, China will complete its transition…to a navy capable of multiple missions around the world.”

The question is to what extent Beijing will be able to reconcile a posture that pressures its neighbors in waters close to home, while seeking to protect growing interests and be seen as a global leader further afield.

No comments:

Post a Comment